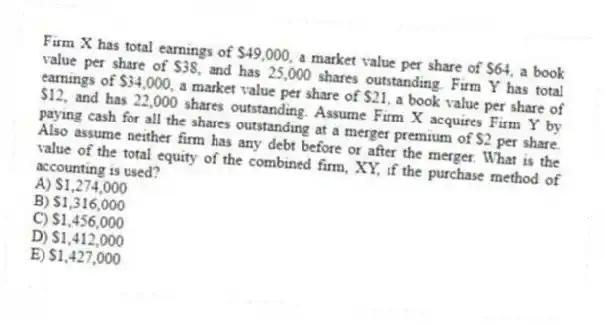

Firm X has total earnings of $49,000, a market value per share of $64, a book value per share of $38, and has 25,000 shares outstanding. Firm Y has total earnings of $34,000, a market value per share of $21, a book value per share of $12, and has 22,000 shares outstanding. Assume Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $2 per share. Also assume neither firm has any debt before or after the merger. What is the value of the total equity of the combined firm, XY, if the purchase method of accounting is used?

A) $1,274,000

B) $1,316,000

C) $1,456,000

D) $1,412,000

E) $1,427,000

Correct Answer:

Verified

Q37: All of the following are examples of

Q38: Black Teas recently acquired Green Teas in

Q39: Which one of the following pairs of

Q40: When evaluating an acquisition you should:

A) concentrate

Q41: The balance sheet of MT Co. shows

Q43: Which one of the following generally has

Q44: An acquisition completed simply to diversify a

Q45: Roger is a major shareholder in RB

Q46: Melvin was attempting to gain control of

Q47: Which one of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents