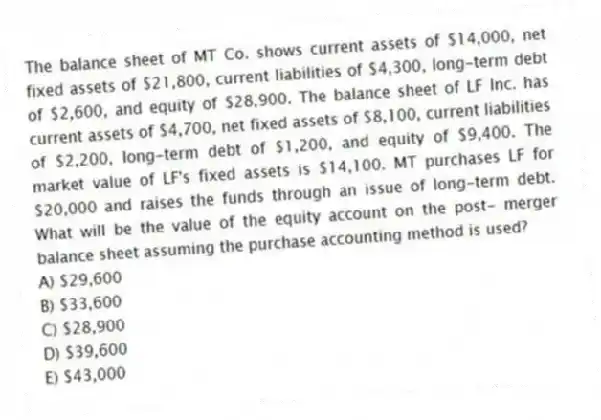

The balance sheet of MT Co. shows current assets of $14,000, net fixed assets of $21,800, current liabilities of $4,300, long-term debt of $2,600, and equity of $28,900. The balance sheet of LF Inc. has current assets of $4,700, net fixed assets of $8,100, current liabilities of $2,200, long-term debt of $1,200, and equity of $9,400. The market value of LF's fixed assets is $14,100. MT purchases LF for $20,000 and raises the funds through an issue of long-term debt. What will be the value of the equity account on the post- merger balance sheet assuming the purchase accounting method is used?

A) $29,600

B) $33,600

C) $28,900

D) $39,600

E) $43,000

Correct Answer:

Verified

Q36: Which one of the following statements is

Q37: All of the following are examples of

Q38: Black Teas recently acquired Green Teas in

Q39: Which one of the following pairs of

Q40: When evaluating an acquisition you should:

A) concentrate

Q42: Firm X has total earnings of $49,000,

Q43: Which one of the following generally has

Q44: An acquisition completed simply to diversify a

Q45: Roger is a major shareholder in RB

Q46: Melvin was attempting to gain control of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents