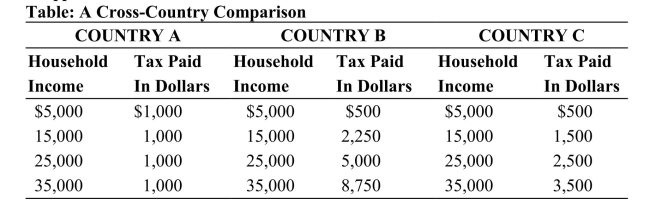

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which countries have a progressive tax system?

A) A and B only

B) B and C only

C) B only

D) None of the countries has it.

Correct Answer:

Verified

Q41: The U.S. corporate tax rate is _,

Q42: If you pay an average tax rate

Q44: Households in the top 20 percent of

Q47: Who pays the most federal taxes?

A) top

Q48: In which of the following tax systems

Q49: This table shows data on taxes paid

Q50: What kind of tax has higher average

Q64: The purpose of FICA taxes is to

Q87: Under a regressive tax, people with higher

Q92: The U.S. individual income tax system can

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents