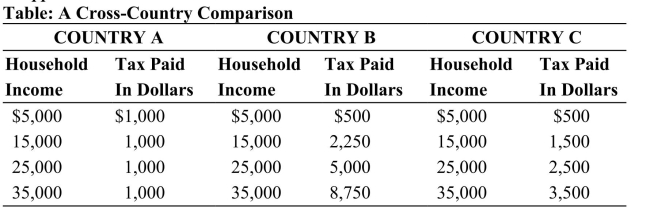

This table shows data on taxes paid by three individuals living in each of three countries: A, B, and C. The tax paid in dollars is based on the marginal tax rates assessed in each of the three countries. Assume that each individual earns an income of exactly $37,000, and there are no deductions or exemptions that need to be applied.  Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a flat tax rate system?

Reference: Ref 17-2 (Table: A Cross-Country Comparison) According to the data in the table, which country has a flat tax rate system?

A) A and B only

B) A and C only

C) C only

D) None of the countries has it.

Correct Answer:

Verified

Q44: Households in the top 20 percent of

Q45: This table shows data on taxes paid

Q47: Who pays the most federal taxes?

A) top

Q48: In which of the following tax systems

Q50: What kind of tax has higher average

Q51: In the United States, the corporate income

Q53: Households in the bottom 20 percent of

Q54: The U.S. tax system is

A) progressive.

B) flat.

C)

Q92: The U.S. individual income tax system can

Q115: The entire U.S. tax system is moderately:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents