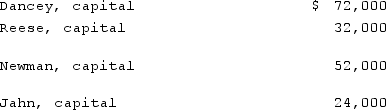

Dancey, Reese, Newman, and Jahn were partners who shared profits and losses on a 4:2:2:2 basis, respectively. They were beginning to liquidate their business. At the start of the process, Capital account balances were as follows:  Which one of the following statements is true for a predistribution plan?

Which one of the following statements is true for a predistribution plan?

A) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared equally between Dancey, Reese, and Newman. A total distribution of $60,000 would be required before all four partners share any further payments equally.

B) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $60,000 before all four partners share any further payments in their profit and loss sharing ratios.

C) The first $20,000 would go to Newman. The next $8,000 would go to Dancey. The next $12,000 would be shared equally by Dancey, Reese, and Newman. The total distribution would be $40,000 before all four partners share any further payments equally.

D) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments equally.

E) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments in their profit and loss sharing ratios.

Correct Answer:

Verified

Q9: Which of the following could result in

Q14: The Keller, Long, and Mason partnership had

Q15: A local partnership was in the process

Q16: The Allen, Bevell, and Carter partnership began

Q18: The following account balances were available for

Q20: A local partnership was considering the possibility

Q23: The Amos, Billings, and Cleaver partnership had

Q24: A partnership has assets of cash of

Q28: Which item is not shown on the

Q31: The partnership of Gordon, Handel, and Mitchell

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents