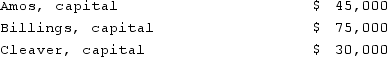

The Amos, Billings, and Cleaver partnership had two assets: (1)cash of $40,000 and (2)an investment with a book value of $110,000. The ratio for sharing profits and losses is 2:1:1. The balances in the capital accounts were:

Required:If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

Required:If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

Correct Answer:

Verified

Q18: The following account balances were available for

Q19: Dancey, Reese, Newman, and Jahn were partners

Q20: A local partnership was considering the possibility

Q21: At the end of a partnership liquidation,

Q24: A partnership has assets of cash of

Q25: White, Sands, and Luke has the following

Q27: A proposed schedule of liquidation is developed

A)

Q28: Which item is not shown on the

Q31: The partnership of Gordon, Handel, and Mitchell

Q32: A local partnership has assets of cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents