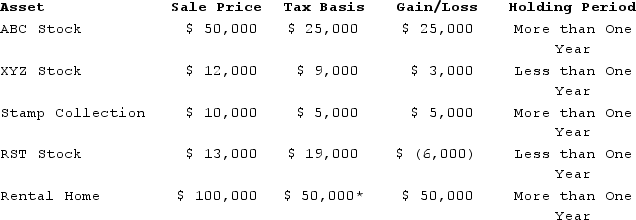

Henry, a single taxpayer with a marginal tax rate of 35 percent(taxable income is $300,000 before considering any of the items below), sold the following assets during the year:

*$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

*$25,000 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

What tax rate(s)will apply to Henry's capital gains or losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: On the sale of a passive activity,

Q66: The rental real estate exception favors:

A)lower-income taxpayers

Q67: Mr. and Mrs. Smith purchased 100 shares

Q68: On December 1, 20X7, George Jimenez needed

Q69: Henry, a single taxpayer with a marginal

Q71: How are individual taxpayers' investment expenses and

Q72: What are the rules limiting the amount

Q73: On December 1, 20X7, George Jimenez needed

Q74: A taxpayer's at-risk amount in an activity

Q75: On January 1, 20X1, Fred purchased a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents