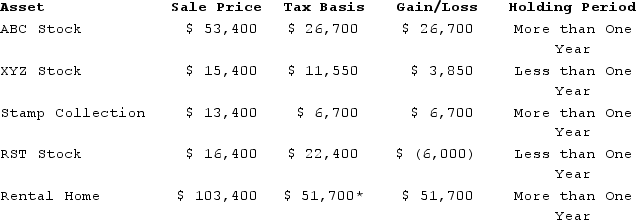

Henry, a single taxpayer with a marginal tax rate of 35 percent(taxable income is $317,000 before considering any of the items below), sold the following assets during the year:

*$25,850 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

*$25,850 of the gain is a 25 percent gain. The remaining gain is 0/15/20 percent gain.

What tax rate(s)will apply to Henry's capital gains or losses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Sarantuya, a college student, feels that now

Q65: On the sale of a passive activity,

Q66: The rental real estate exception favors:

A)lower-income taxpayers

Q67: Mr. and Mrs. Smith purchased 100 shares

Q68: On December 1, 20X7, George Jimenez needed

Q70: Henry, a single taxpayer with a marginal

Q71: How are individual taxpayers' investment expenses and

Q72: What are the rules limiting the amount

Q73: On December 1, 20X7, George Jimenez needed

Q74: A taxpayer's at-risk amount in an activity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents