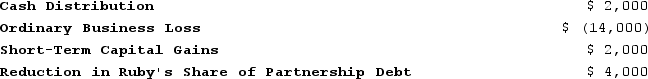

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: ER General Partnership, a medical supplies business,

Q114: Lloyd and Harry, equal partners, form the

Q115: At the end of Year 1, Tony

Q116: This year, Reggie's distributive share from Almonte

Q117: Alfred, a one-third profits and capital partner

Q119: Why are guaranteed payments deducted in calculating

Q120: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q121: Explain why partners must increase their tax

Q122: Bob is a general partner in Fresh

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents