Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

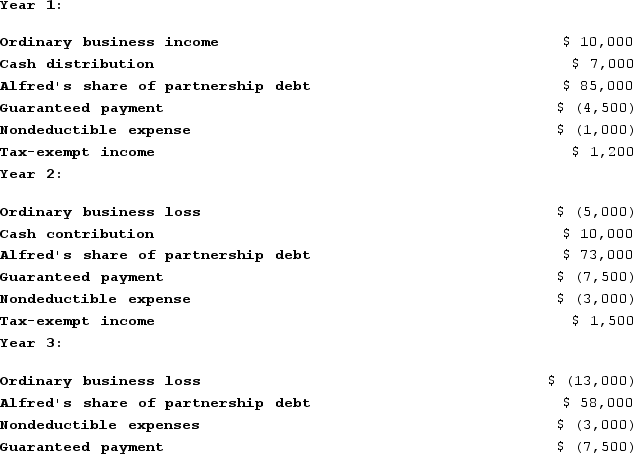

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: This year, Reggie's distributive share from Almonte

Q113: ER General Partnership, a medical supplies business,

Q114: Lloyd and Harry, equal partners, form the

Q115: At the end of Year 1, Tony

Q116: This year, Reggie's distributive share from Almonte

Q118: Ruby's tax basis in her partnership interest

Q119: Why are guaranteed payments deducted in calculating

Q120: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q121: Explain why partners must increase their tax

Q122: Bob is a general partner in Fresh

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents