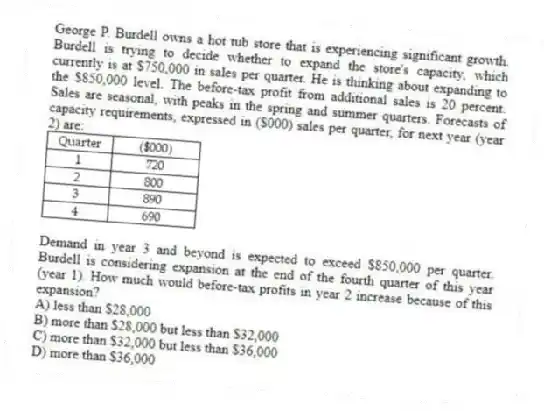

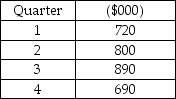

George P. Burdell owns a hot tub store that is experiencing significant growth. Burdell is trying to decide whether to expand the store's capacity, which currently is at $750,000 in sales per quarter. He is thinking about expanding to the $850,000 level. The before-tax profit from additional sales is 20 percent. Sales are seasonal, with peaks in the spring and summer quarters. Forecasts of capacity requirements, expressed in ($000) sales per quarter, for next year (year 2) are:

Demand in year 3 and beyond is expected to exceed $850,000 per quarter. Burdell is considering expansion at the end of the fourth quarter of this year (year 1) . How much would before-tax profits in year 2 increase because of this expansion?

A) less than $28,000

B) more than $28,000 but less than $32,000

C) more than $32,000 but less than $36,000

D) more than $36,000

Correct Answer:

Verified

Q74: A company's production facility, consisting of two

Q75: Innovative Inc. is experiencing a boom for

Q76: Table 4.1

The Union Manufacturing Company is producing

Q77: A well-educated operations manager used the capacity

Q78: The time required to change a machine

Q80: A standard work year is 2,000 hours

Q81: Scenario 4.6

Burdell Labs is a diagnostic laboratory

Q82: A process's _ is what its capacity

Q83: A process's _ is the length of

Q84: Scenario 4.5

The T. H. King Company has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents