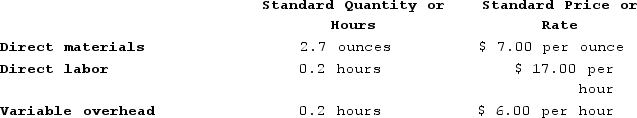

Doby Corporation makes a product with the following standard costs:

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

In July the company produced 4,800 units using 13,450 ounces of the direct material and 970 direct labor-hours. During the month the company purchased 14,600 ounces of the direct material at a price of $7.20 per ounce. The actual direct labor rate was $16.20 per hour and the actual variable overhead rate was $5.40 per hour. The materials price variance is computed when materials are purchased. Variable overhead is applied on the basis of direct labor-hours.

Required:

a. Compute the materials quantity variance.

b. Compute the materials price variance.

c. Compute the labor efficiency variance.

d. Compute the labor rate variance.

e. Compute the variable overhead efficiency variance.

f. Compute the variable overhead rate variance.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q369: The standards for product V28 call for

Q370: Camps Incorporated has a standard cost system.

Q371: Woodhead Incorporated manufactures one product. It does

Q372: Kropf Incorporated has provided the following data

Q373: Woodhead Incorporated manufactures one product. It does

Q375: Klacic Corporation makes a product with the

Q376: Jungman Incorporated has provided the following data

Q377: Alvino Corporation manufactures one product. It does

Q378: A partial standard cost card for the

Q379: Becka Incorporated has provided the following data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents