Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, Formed

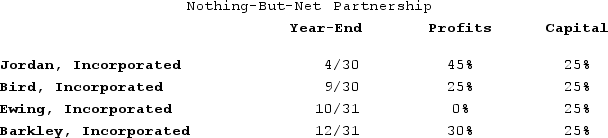

Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, formed Nothing-But-Net Partnership on June 1st, 20X9. Now, Nothing-But-Net must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Nothing-But-Net use, and what rule requires this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Greg, a 40percent partner in GSS Partnership,

Q109: Alfred, a one-third profits and capital partner

Q110: Illuminating Light Partnership had the following revenues,

Q111: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q112: Ruby's tax basis in her partnership interest

Q112: This year, Reggie's distributive share from Almonte

Q113: Ruby's tax basis in her partnership interest

Q116: Illuminating Light Partnership had the following revenues,

Q118: Lloyd and Harry, equal partners, form the

Q119: Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents