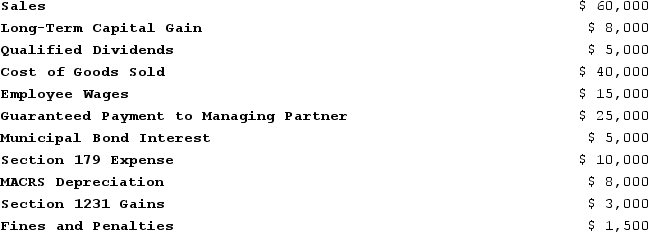

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Greg, a 40percent partner in GSS Partnership,

Q111: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q112: This year, Reggie's distributive share from Almonte

Q112: Ruby's tax basis in her partnership interest

Q113: Ruby's tax basis in her partnership interest

Q114: Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and

Q118: Lloyd and Harry, equal partners, form the

Q119: Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated,

Q120: Lloyd and Harry, equal partners, form the

Q129: Clint noticed that the Schedule K-1 he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents