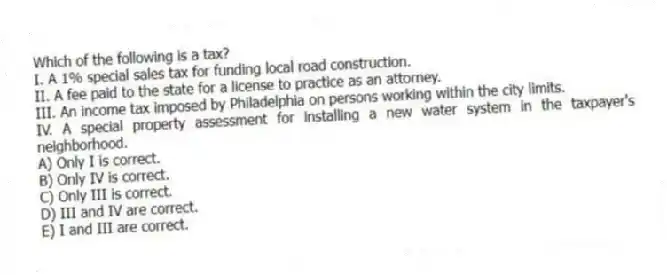

Which of the following is a tax?

I. A 1% special sales tax for funding local road construction.

II. A fee paid to the state for a license to practice as an attorney.

III. An income tax imposed by Philadelphia on persons working within the city limits.

IV. A special property assessment for installing a new water system in the taxpayer's neighborhood.

A) Only I is correct.

B) Only IV is correct.

C) Only III is correct.

D) III and IV are correct.

E) I and III are correct.

Correct Answer:

Verified

Q54: Sin taxes are:

A) taxes assessed by religious

Q55: Which of the following is not an

Q56: Marc, a single taxpayer, earns $60,000 in

Q57: The city of Granby, Colorado recently enacted

Q58: Earmarked taxes are:

A) taxes assessed only on

Q60: Which of the following is True regarding

Q61: Leonardo, who is married but files separately, earns

Q62: Which of the following statements is True?

A)

Q63: Which of the following federal government actions

Q64: Leonardo, who is married but files separately,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents