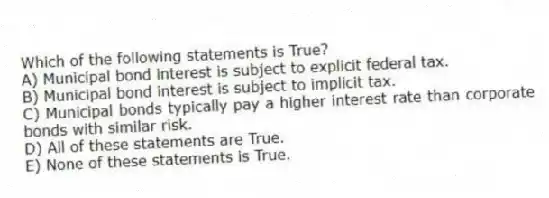

Which of the following statements is True?

A) Municipal bond interest is subject to explicit federal tax.

B) Municipal bond interest is subject to implicit tax.

C) Municipal bonds typically pay a higher interest rate than corporate bonds with similar risk.

D) All of these statements are True.

E) None of these statements is True.

Correct Answer:

Verified

Q57: The city of Granby, Colorado recently enacted

Q58: Earmarked taxes are:

A) taxes assessed only on

Q59: Which of the following is a tax?

I.

Q60: Which of the following is True regarding

Q61: Leonardo, who is married but files separately, earns

Q63: Which of the following federal government actions

Q64: Leonardo, who is married but files separately,

Q65: The substitution effect:

A) predicts that taxpayers will

Q66: Which of the following principles encourages a

Q67: Manny, a single taxpayer, earns $65,000 per

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents