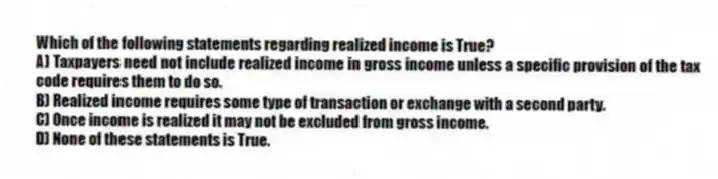

Which of the following statements regarding realized income is True?

A) Taxpayers need not include realized income in gross income unless a specific provision of the tax code requires them to do so.

B) Realized income requires some type of transaction or exchange with a second party.

C) Once income is realized it may not be excluded from gross income.

D) None of these statements is True.

Correct Answer:

Verified

Q51: Which of the following series of inequalities

Q52: In certain circumstances, a married taxpayer who

Q53: Sally received $60,000 of compensation from her

Q54: If an unmarried taxpayer provides more than

Q55: If an unmarried taxpayer is eligible to claim

Q57: Bonnie and Ernie file a joint return.

Q58: The income tax base for an individual

Q59: Jeremy and Annie are married. During the

Q60: A taxpayer may qualify for the head

Q61: Which of the following shows the correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents