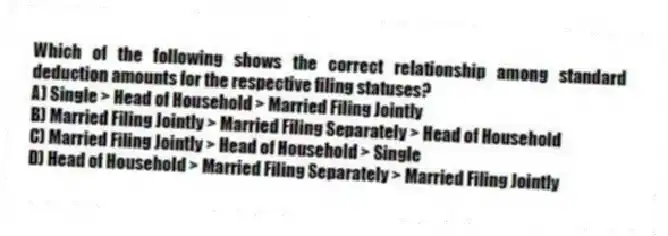

Which of the following shows the correct relationship among standard deduction amounts for the respective filing statuses?

A) Single > Head of Household > Married Filing Jointly

B) Married Filing Jointly > Married Filing Separately > Head of Household

C) Married Filing Jointly > Head of Household > Single

D) Head of Household > Married Filing Separately > Married Filing Jointly

Correct Answer:

Verified

Q56: Which of the following statements regarding realized

Q57: Bonnie and Ernie file a joint return.

Q58: The income tax base for an individual

Q59: Jeremy and Annie are married. During the

Q60: A taxpayer may qualify for the head

Q62: Which of the following statements regarding tax

Q63: In year 1, the Bennetts' 25-year-old daughter,

Q64: Which of the following statements is True?

A)

Q65: Jamison's gross tax liability is $7,000. Jamison

Q66: Which of the following statements regarding dependents is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents