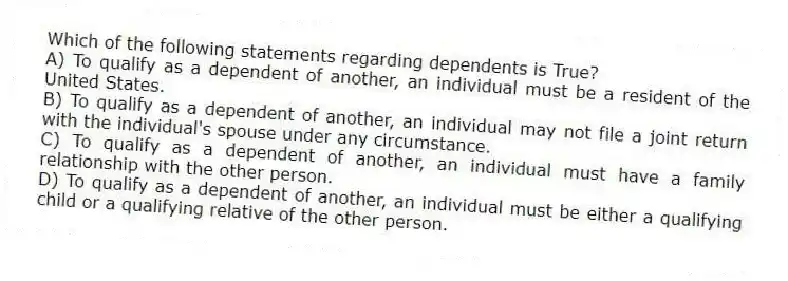

Which of the following statements regarding dependents is True?

A) To qualify as a dependent of another, an individual must be a resident of the United States.

B) To qualify as a dependent of another, an individual may not file a joint return with the individual's spouse under any circumstance.

C) To qualify as a dependent of another, an individual must have a family relationship with the other person.

D) To qualify as a dependent of another, an individual must be either a qualifying child or a qualifying relative of the other person.

Correct Answer:

Verified

Q61: Which of the following shows the correct

Q62: Which of the following statements regarding tax

Q63: In year 1, the Bennetts' 25-year-old daughter,

Q64: Which of the following statements is True?

A)

Q65: Jamison's gross tax liability is $7,000. Jamison

Q67: Madison's gross tax liability is $9,000. Madison

Q68: Which of the following relationships does NOT

Q69: Which of the following statements regarding tax

Q70: Charlotte is the Lucas family's 22-year-old daughter.

Q71: Joanna received $60,000 compensation from her employer,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents