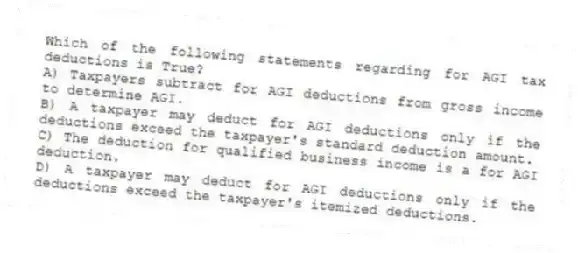

Which of the following statements regarding for AGI tax deductions is True?

A) Taxpayers subtract for AGI deductions from gross income to determine AGI.

B) A taxpayer may deduct for AGI deductions only if the deductions exceed the taxpayer's standard deduction amount.

C) The deduction for qualified business income is a for AGI deduction.

D) A taxpayer may deduct for AGI deductions only if the deductions exceed the taxpayer's itemized deductions.

Correct Answer:

Verified

Q72: Which of the following is not an

Q73: All of the following are for AGI

Q74: All of the following are tests for

Q75: Which of the following statements regarding dependents

Q76: All of the following represents a type

Q78: Which of the following is NOT a

Q79: Which of the following types of income

Q80: Anna is a 21-year-old full-time college student

Q81: In June of year 1, Eric's wife

Q82: Jane is unmarried and has no children,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents