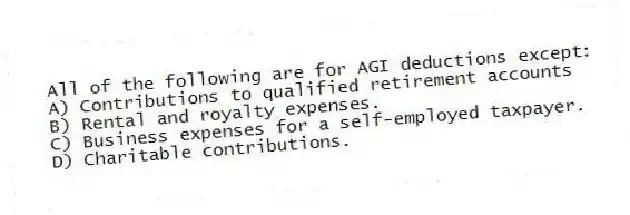

All of the following are for AGI deductions except:

A) Contributions to qualified retirement accounts

B) Rental and royalty expenses.

C) Business expenses for a self-employed taxpayer.

D) Charitable contributions.

Correct Answer:

Verified

Q68: Which of the following relationships does NOT

Q69: Which of the following statements regarding tax

Q70: Charlotte is the Lucas family's 22-year-old daughter.

Q71: Joanna received $60,000 compensation from her employer,

Q72: Which of the following is not an

Q74: All of the following are tests for

Q75: Which of the following statements regarding dependents

Q76: All of the following represents a type

Q77: Which of the following statements regarding for

Q78: Which of the following is NOT a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents