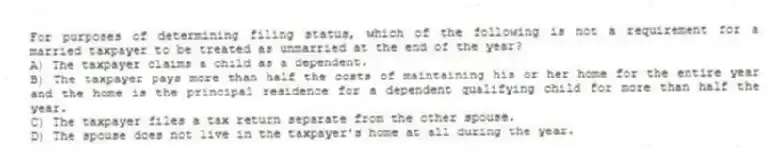

For purposes of determining filing status, which of the following is not a requirement for a married taxpayer to be treated as unmarried at the end of the year?

A) The taxpayer claims a child as a dependent.

B) The taxpayer pays more than half the costs of maintaining his or her home for the entire year and the home is the principal residence for a dependent qualifying child for more than half the year.

C) The taxpayer files a tax return separate from the other spouse.

D) The spouse does not live in the taxpayer's home at all during the year.

Correct Answer:

Verified

Q101: Tom Suzuki's tax liability for the year

Q102: Jane and Ed Rochester are married with

Q103: Jane and Ed Rochester are married with

Q104: Sam and Tracy have been married for 25

Q105: Jane and Ed Rochester are married with

Q107: Kabuo and Melinda got married on December

Q108: Jasmine and her husband Arty have been

Q109: In year 1, Harold Weston's wife died.

Q110: The Inouyes filed jointly in 2018. Their

Q111: Greg is single. During 2018, he received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents