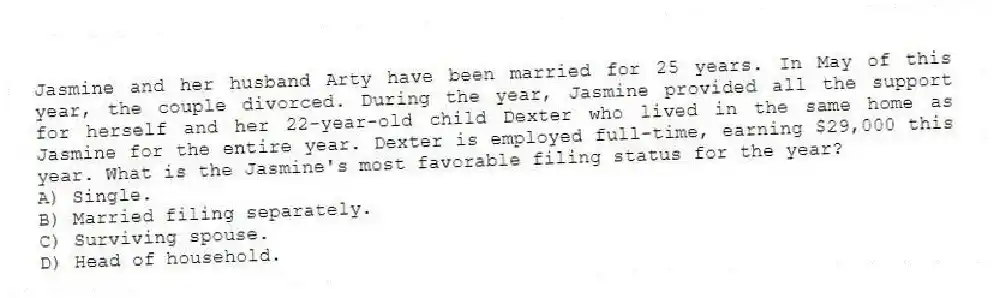

Jasmine and her husband Arty have been married for 25 years. In May of this year, the couple divorced. During the year, Jasmine provided all the support for herself and her 22-year-old child Dexter who lived in the same home as Jasmine for the entire year. Dexter is employed full-time, earning $29,000 this year. What is the Jasmine's most favorable filing status for the year?

A) Single.

B) Married filing separately.

C) Surviving spouse.

D) Head of household.

Correct Answer:

Verified

Q103: Jane and Ed Rochester are married with

Q104: Sam and Tracy have been married for 25

Q105: Jane and Ed Rochester are married with

Q106: For purposes of determining filing status, which of

Q107: Kabuo and Melinda got married on December

Q109: In year 1, Harold Weston's wife died.

Q110: The Inouyes filed jointly in 2018. Their

Q111: Greg is single. During 2018, he received

Q112: Miguel, a widower whose wife died in

Q113: For filing status purposes, the taxpayer's marital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents