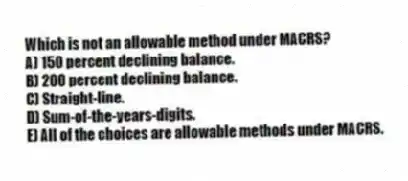

Which is not an allowable method under MACRS?

A) 150 percent declining balance.

B) 200 percent declining balance.

C) Straight-line.

D) Sum-of-the-years-digits.

E) All of the choices are allowable methods under MACRS.

Correct Answer:

Verified

Q38: The alternative depreciation system requires both a

Q39: In general, major integrated oil and gas

Q40: If the business use percentage for listed

Q41: Lax, LLC purchased only one asset during

Q42: Which depreciation convention is the general rule

Q44: Suvi, Inc. purchased two assets during the

Q45: Wheeler LLC purchased two assets during the

Q46: Beth's business purchased only one asset during

Q47: Poplock LLC purchased a warehouse and land

Q48: The MACRS recovery period for automobiles and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents