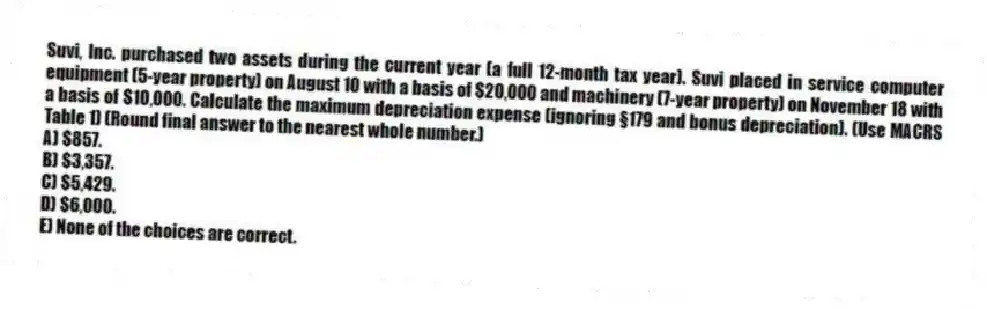

Suvi, Inc. purchased two assets during the current year (a full 12-month tax year) . Suvi placed in service computer equipment (5-year property) on August 10 with a basis of $20,000 and machinery (7-year property) on November 18 with a basis of $10,000. Calculate the maximum depreciation expense (ignoring §179 and bonus depreciation) . (Use MACRS Table 1) (Round final answer to the nearest whole number.)

A) $857.

B) $3,357.

C) $5,429.

D) $6,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q39: In general, major integrated oil and gas

Q40: If the business use percentage for listed

Q41: Lax, LLC purchased only one asset during

Q42: Which depreciation convention is the general rule

Q43: Which is not an allowable method under

Q45: Wheeler LLC purchased two assets during the

Q46: Beth's business purchased only one asset during

Q47: Poplock LLC purchased a warehouse and land

Q48: The MACRS recovery period for automobiles and

Q49: How is the recovery period of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents