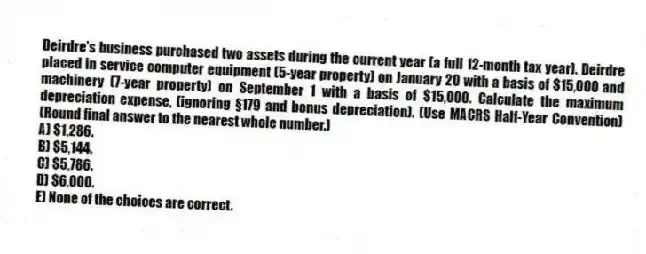

Deirdre's business purchased two assets during the current year (a full 12-month tax year) . Deirdre placed in service computer equipment (5-year property) on January 20 with a basis of $15,000 and machinery (7-year property) on September 1 with a basis of $15,000. Calculate the maximum depreciation expense, (ignoring §179 and bonus depreciation) . (Use MACRS Half-Year Convention) (Round final answer to the nearest whole number.)

A) $1,286.

B) $5,144.

C) $5,786.

D) $6,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q45: Wheeler LLC purchased two assets during the

Q46: Beth's business purchased only one asset during

Q47: Poplock LLC purchased a warehouse and land

Q48: The MACRS recovery period for automobiles and

Q49: How is the recovery period of an

Q51: Which of the following would be considered

Q52: Tasha LLC purchased furniture (7-year property) on

Q53: Sairra, LLC purchased only one asset during

Q54: Tax depreciation is currently calculated under what

Q55: Anne LLC purchased computer equipment (5-year property)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents