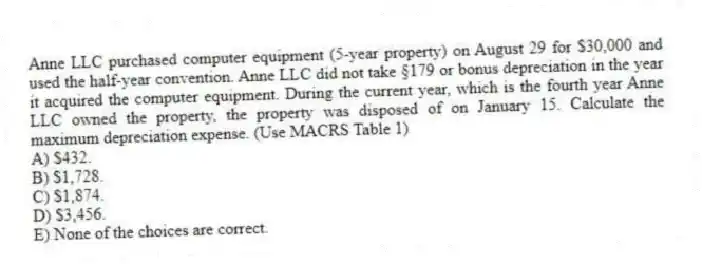

Anne LLC purchased computer equipment (5-year property) on August 29 for $30,000 and used the half-year convention. Anne LLC did not take §179 or bonus depreciation in the year it acquired the computer equipment. During the current year, which is the fourth year Anne LLC owned the property, the property was disposed of on January 15. Calculate the maximum depreciation expense. (Use MACRS Table 1)

A) $432.

B) $1,728.

C) $1,874.

D) $3,456.

E) None of the choices are correct.

Correct Answer:

Verified

Q50: Deirdre's business purchased two assets during the

Q51: Which of the following would be considered

Q52: Tasha LLC purchased furniture (7-year property) on

Q53: Sairra, LLC purchased only one asset during

Q54: Tax depreciation is currently calculated under what

Q56: Tom Tom LLC purchased a rental house

Q57: Which of the following is not usually

Q58: An example of an asset that is

Q59: Which of the allowable methods allows the

Q60: Which of the following depreciation conventions are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents