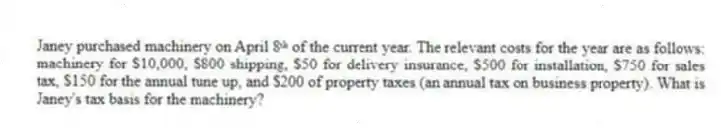

Janey purchased machinery on April 8ᵗʰ of the current year. The relevant costs for the year are as follows: machinery for $10,000, $800 shipping, $50 for delivery insurance, $500 for installation, $750 for sales tax, $150 for the annual tune up, and $200 of property taxes (an annual tax on business property). What is Janey's tax basis for the machinery?

Correct Answer:

Verified

An asset's basis consists of al...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Daschle LLC completed some research and development

Q78: Arlington LLC purchased an automobile for $55,000

Q79: Gessner LLC patented a process it developed

Q80: Bonnie Jo purchased a used camera (5-year

Q81: During August of the prior year, Julio

Q83: Roth, LLC purchased only one asset during

Q84: Flax, LLC purchased only one asset this

Q85: Yasmin purchased two assets during the current

Q86: Reid acquired two assets in 2018: computer

Q87: An office building was purchased on December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents