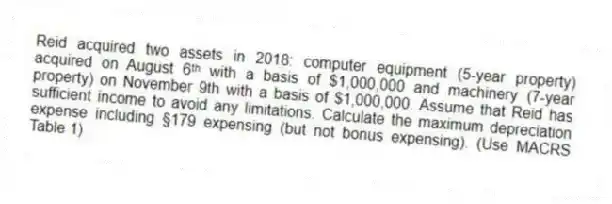

Reid acquired two assets in 2018: computer equipment (5-year property) acquired on August 6ᵗʰ with a basis of $1,000,000 and machinery (7-year property) on November 9th with a basis of $1,000,000. Assume that Reid has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (but not bonus expensing). (Use MACRS Table 1)

Correct Answer:

Verified

The $1,000,000 §179 expense ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: During August of the prior year, Julio

Q82: Janey purchased machinery on April 8ᵗʰ of

Q83: Roth, LLC purchased only one asset during

Q84: Flax, LLC purchased only one asset this

Q85: Yasmin purchased two assets during the current

Q87: An office building was purchased on December

Q88: Santa Fe purchased the rights to extract

Q89: Northern LLC only purchased one asset this

Q90: Columbia LLC only purchased one asset this

Q91: Timothy purchased a new computer for his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents