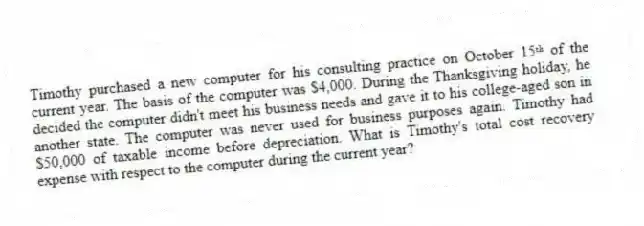

Timothy purchased a new computer for his consulting practice on October 15ᵗʰ of the current year. The basis of the computer was $4,000. During the Thanksgiving holiday, he decided the computer didn't meet his business needs and gave it to his college-aged son in another state. The computer was never used for business purposes again. Timothy had $50,000 of taxable income before depreciation. What is Timothy's total cost recovery expense with respect to the computer during the current year?

Correct Answer:

Verified

No depreciation expense or...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Reid acquired two assets in 2018: computer

Q87: An office building was purchased on December

Q88: Santa Fe purchased the rights to extract

Q89: Northern LLC only purchased one asset this

Q90: Columbia LLC only purchased one asset this

Q92: Lucky Strike Mine (LLC) purchased a silver

Q93: Kristine sold two assets on March 20th

Q94: Amit purchased two assets during the current

Q95: Bonnie Jo used two assets during the

Q96: Eddie purchased only one asset during the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents