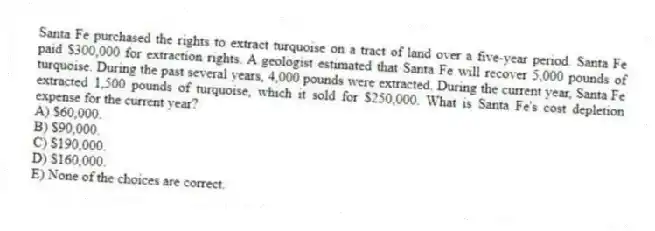

Santa Fe purchased the rights to extract turquoise on a tract of land over a five-year period. Santa Fe paid $300,000 for extraction rights. A geologist estimated that Santa Fe will recover 5,000 pounds of turquoise. During the past several years, 4,000 pounds were extracted. During the current year, Santa Fe extracted 1,500 pounds of turquoise, which it sold for $250,000. What is Santa Fe's cost depletion expense for the current year?

A) $60,000.

B) $90,000.

C) $190,000.

D) $160,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q83: Roth, LLC purchased only one asset during

Q84: Flax, LLC purchased only one asset this

Q85: Yasmin purchased two assets during the current

Q86: Reid acquired two assets in 2018: computer

Q87: An office building was purchased on December

Q89: Northern LLC only purchased one asset this

Q90: Columbia LLC only purchased one asset this

Q91: Timothy purchased a new computer for his

Q92: Lucky Strike Mine (LLC) purchased a silver

Q93: Kristine sold two assets on March 20th

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents