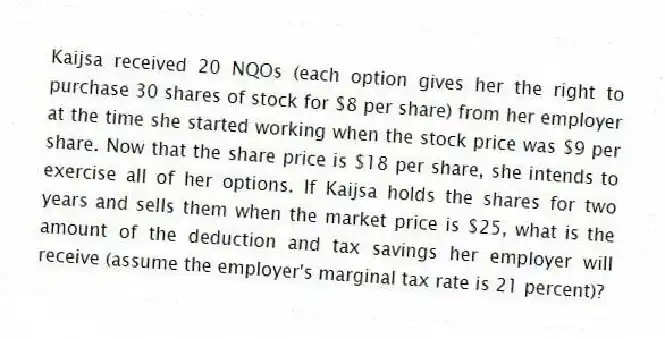

Kaijsa received 20 NQOs (each option gives her the right to purchase 30 shares of stock for $8 per share) from her employer at the time she started working when the stock price was $9 per share. Now that the share price is $18 per share, she intends to exercise all of her options. If Kaijsa holds the shares for two years and sells them when the market price is $25, what is the amount of the deduction and tax savings her employer will receive (assume the employer's marginal tax rate is 21 percent)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Rick recently received 500 shares of restricted

Q86: Suzanne received 20 ISOs (each option gives

Q87: Kimberly's employer provides her with a personal

Q88: Suzanne received 20 ISOs (each option gives

Q89: Jane is an employee of Rohrs Golf

Q91: Rick recently received 500 shares of restricted

Q92: Annika's employer provides only its executives with

Q93: Hope's employer is now offering group-term life

Q94: Annika's employer provides each employee with up

Q95: Corinne's employer offers a cafeteria plan that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents