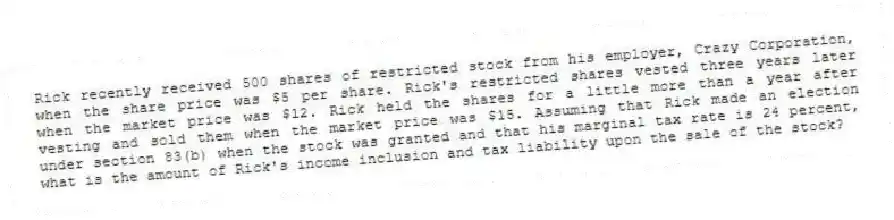

Rick recently received 500 shares of restricted stock from his employer, Crazy Corporation, when the share price was $5 per share. Rick's restricted shares vested three years later when the market price was $12. Rick held the shares for a little more than a year after vesting and sold them when the market price was $15. Assuming that Rick made an election under section 83(b) when the stock was granted and that his marginal tax rate is 24 percent, what is the amount of Rick's income inclusion and tax liability upon the sale of the stock?

Correct Answer:

Verified

$5,000 [500 s...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Which of the following is a fringe

Q81: Suzanne received 20 ISOs (each option gives

Q82: Rick recently received 500 shares of restricted

Q83: Frederique works for a furniture retailer. The

Q84: Hazel received 20 NQOs (each option gives

Q86: Suzanne received 20 ISOs (each option gives

Q87: Kimberly's employer provides her with a personal

Q88: Suzanne received 20 ISOs (each option gives

Q89: Jane is an employee of Rohrs Golf

Q90: Kaijsa received 20 NQOs (each option gives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents