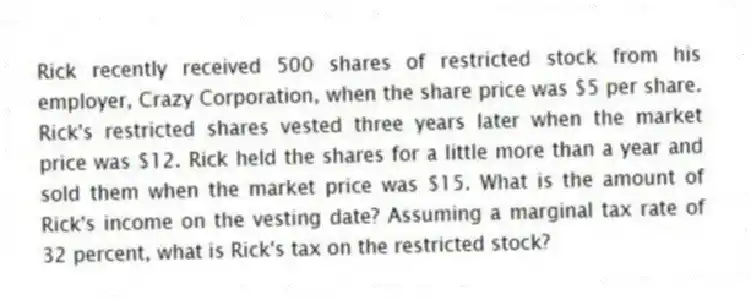

Rick recently received 500 shares of restricted stock from his employer, Crazy Corporation, when the share price was $5 per share. Rick's restricted shares vested three years later when the market price was $12. Rick held the shares for a little more than a year and sold them when the market price was $15. What is the amount of Rick's income on the vesting date? Assuming a marginal tax rate of 32 percent, what is Rick's tax on the restricted stock?

Correct Answer:

Verified

$6,000 (500...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Rachel receives employer provided health insurance. The

Q78: Lara, a single taxpayer with a 32

Q79: Which of the following statements regarding employer

Q80: Which of the following is a fringe

Q81: Suzanne received 20 ISOs (each option gives

Q83: Frederique works for a furniture retailer. The

Q84: Hazel received 20 NQOs (each option gives

Q85: Rick recently received 500 shares of restricted

Q86: Suzanne received 20 ISOs (each option gives

Q87: Kimberly's employer provides her with a personal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents