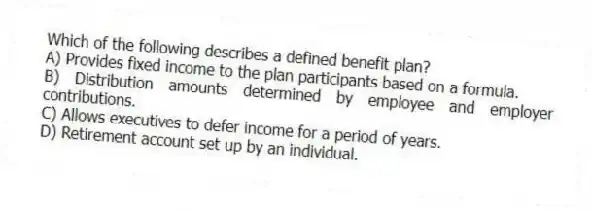

Which of the following describes a defined benefit plan?

A) Provides fixed income to the plan participants based on a formula.

B) Distribution amounts determined by employee and employer contributions.

C) Allows executives to defer income for a period of years.

D) Retirement account set up by an individual.

Correct Answer:

Verified

Q34: Taxpayers who participate in an employer-sponsored retirement

Q35: High-income taxpayers are not allowed to receive

Q36: Darren is eligible to contribute to a

Q37: Which of the following statements is True

Q38: Taxpayers never pay tax on the earnings

Q40: Which of the following best describes distributions

Q41: When employees contribute to a traditional 401(k)

Q42: Which of the following statements describes how

Q43: When employees contribute to a Roth 401(k)

Q44: Which of the following statements is True

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents