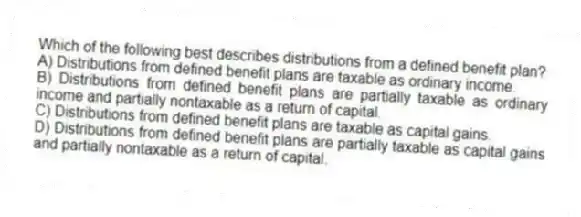

Which of the following best describes distributions from a defined benefit plan?

A) Distributions from defined benefit plans are taxable as ordinary income.

B) Distributions from defined benefit plans are partially taxable as ordinary income and partially nontaxable as a return of capital.

C) Distributions from defined benefit plans are taxable as capital gains.

D) Distributions from defined benefit plans are partially taxable as capital gains and partially nontaxable as a return of capital.

Correct Answer:

Verified

Q35: High-income taxpayers are not allowed to receive

Q36: Darren is eligible to contribute to a

Q37: Which of the following statements is True

Q38: Taxpayers never pay tax on the earnings

Q39: Which of the following describes a defined

Q41: When employees contribute to a traditional 401(k)

Q42: Which of the following statements describes how

Q43: When employees contribute to a Roth 401(k)

Q44: Which of the following statements is True

Q45: Shauna received a $100,000 distribution from her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents