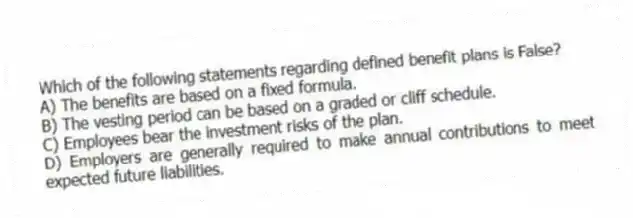

Which of the following statements regarding defined benefit plans is False?

A) The benefits are based on a fixed formula.

B) The vesting period can be based on a graded or cliff schedule.

C) Employees bear the investment risks of the plan.

D) Employers are generally required to make annual contributions to meet expected future liabilities.

Correct Answer:

Verified

Q24: Taxpayers who participate in an employer-sponsored retirement

Q25: Individual 401(k) plans generally have higher contribution

Q26: Qualified distributions from traditional IRAs are nontaxable

Q27: Dean has earned $70,000 annually for the

Q28: If a taxpayer's marginal tax rate is

Q30: Which of the following statements regarding vesting

Q31: Dean has earned $70,000 annually for the

Q32: Taxpayers contributing to and receiving distributions from

Q33: A taxpayer can only receive a saver's

Q34: Taxpayers who participate in an employer-sponsored retirement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents