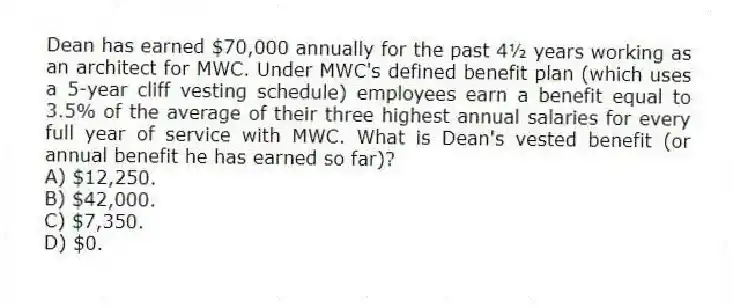

Dean has earned $70,000 annually for the past 4½ years working as an architect for MWC. Under MWC's defined benefit plan (which uses a 5-year cliff vesting schedule) employees earn a benefit equal to 3.5% of the average of their three highest annual salaries for every full year of service with MWC. What is Dean's vested benefit (or annual benefit he has earned so far) ?

A) $12,250.

B) $42,000.

C) $7,350.

D) $0.

Correct Answer:

Verified

Q26: Qualified distributions from traditional IRAs are nontaxable

Q27: Dean has earned $70,000 annually for the

Q28: If a taxpayer's marginal tax rate is

Q29: Which of the following statements regarding defined

Q30: Which of the following statements regarding vesting

Q32: Taxpayers contributing to and receiving distributions from

Q33: A taxpayer can only receive a saver's

Q34: Taxpayers who participate in an employer-sponsored retirement

Q35: High-income taxpayers are not allowed to receive

Q36: Darren is eligible to contribute to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents