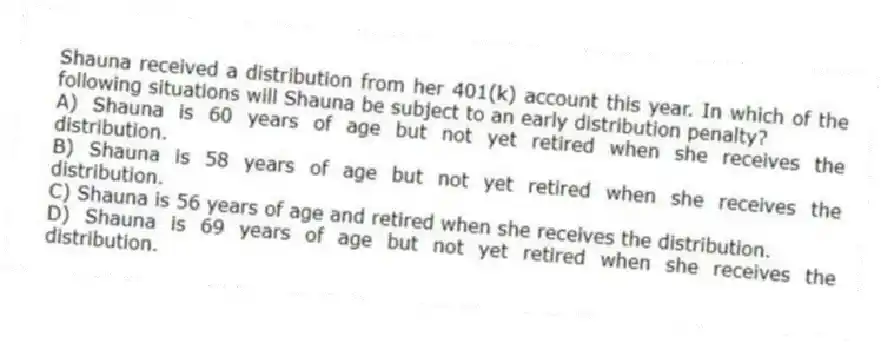

Shauna received a distribution from her 401(k) account this year. In which of the following situations will Shauna be subject to an early distribution penalty?

A) Shauna is 60 years of age but not yet retired when she receives the distribution.

B) Shauna is 58 years of age but not yet retired when she receives the distribution.

C) Shauna is 56 years of age and retired when she receives the distribution.

D) Shauna is 69 years of age but not yet retired when she receives the distribution.

Correct Answer:

Verified

Q42: Which of the following statements describes how

Q43: When employees contribute to a Roth 401(k)

Q44: Which of the following statements is True

Q45: Shauna received a $100,000 distribution from her

Q46: Which of the following statements comparing qualified

Q48: Jenny (35 years old) is considering making

Q49: Which of the following statements regarding contributions

Q50: During 2018, Jacob, a 19 year old

Q51: Riley participates in his employer's 401(k) plan.

Q52: Riley participates in his employer's 401(k) plan.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents