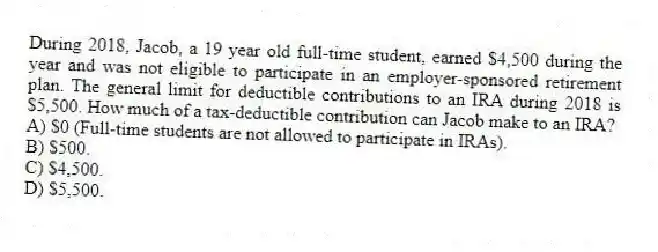

During 2018, Jacob, a 19 year old full-time student, earned $4,500 during the year and was not eligible to participate in an employer-sponsored retirement plan. The general limit for deductible contributions to an IRA during 2018 is $5,500. How much of a tax-deductible contribution can Jacob make to an IRA?

A) $0 (Full-time students are not allowed to participate in IRAs) .

B) $500.

C) $4,500.

D) $5,500.

Correct Answer:

Verified

Q45: Shauna received a $100,000 distribution from her

Q46: Which of the following statements comparing qualified

Q47: Shauna received a distribution from her 401(k)

Q48: Jenny (35 years old) is considering making

Q49: Which of the following statements regarding contributions

Q51: Riley participates in his employer's 401(k) plan.

Q52: Riley participates in his employer's 401(k) plan.

Q53: Which of the following best describes distributions

Q54: Which of the following statements regarding defined

Q55: Which of the following statements is True

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents