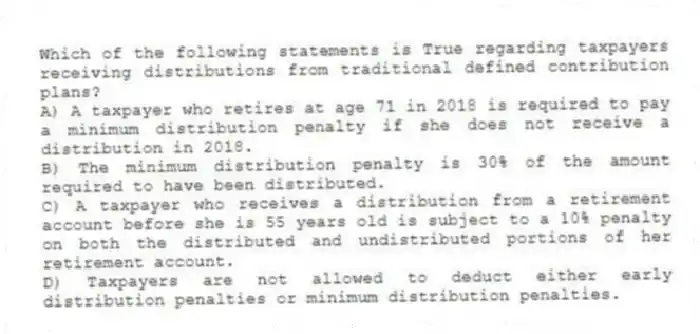

Which of the following statements is True regarding taxpayers receiving distributions from traditional defined contribution plans?

A) A taxpayer who retires at age 71 in 2018 is required to pay a minimum distribution penalty if she does not receive a distribution in 2018.

B) The minimum distribution penalty is 30% of the amount required to have been distributed.

C) A taxpayer who receives a distribution from a retirement account before she is 55 years old is subject to a 10% penalty on both the distributed and undistributed portions of her retirement account.

D) Taxpayers are not allowed to deduct either early distribution penalties or minimum distribution penalties.

Correct Answer:

Verified

Q50: During 2018, Jacob, a 19 year old

Q51: Riley participates in his employer's 401(k) plan.

Q52: Riley participates in his employer's 401(k) plan.

Q53: Which of the following best describes distributions

Q54: Which of the following statements regarding defined

Q56: Which of the following statements concerning nonqualified

Q57: Which of the following is True concerning

Q58: Heidi, age 45, has contributed $20,000 in

Q59: Riley participates in his employer's 401(k) plan.

Q60: Which of the following statements regarding Roth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents