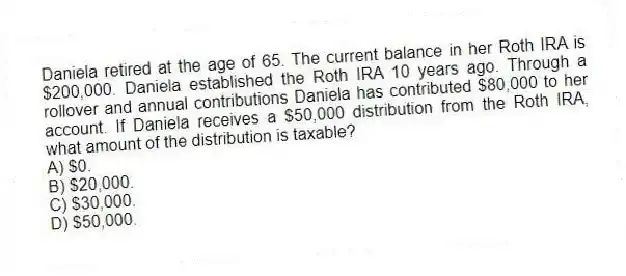

Daniela retired at the age of 65. The current balance in her Roth IRA is $200,000. Daniela established the Roth IRA 10 years ago. Through a rollover and annual contributions Daniela has contributed $80,000 to her account. If Daniela receives a $50,000 distribution from the Roth IRA, what amount of the distribution is taxable?

A) $0.

B) $20,000.

C) $30,000.

D) $50,000.

Correct Answer:

Verified

Q58: Heidi, age 45, has contributed $20,000 in

Q59: Riley participates in his employer's 401(k) plan.

Q60: Which of the following statements regarding Roth

Q61: Which of the following statements regarding traditional

Q62: In general, which of the following statements

Q64: Kathy is 60 years of age and

Q65: Tyson (48 years old) owns a traditional

Q66: Tyson (48 years old) owns a traditional

Q67: Bryan, who is 45 years old, had

Q68: Which of the following statements regarding IRAs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents