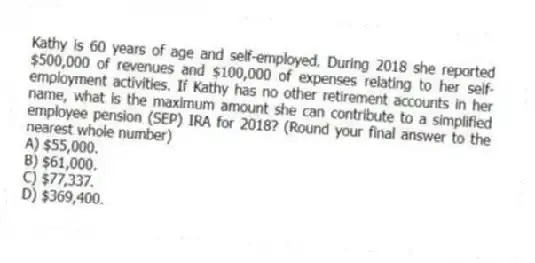

Kathy is 60 years of age and self-employed. During 2018 she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018? (Round your final answer to the nearest whole number)

A) $55,000.

B) $61,000.

C) $77,337.

D) $369,400.

Correct Answer:

Verified

Q59: Riley participates in his employer's 401(k) plan.

Q60: Which of the following statements regarding Roth

Q61: Which of the following statements regarding traditional

Q62: In general, which of the following statements

Q63: Daniela retired at the age of 65.

Q65: Tyson (48 years old) owns a traditional

Q66: Tyson (48 years old) owns a traditional

Q67: Bryan, who is 45 years old, had

Q68: Which of the following statements regarding IRAs

Q69: Which of the following statements regarding Roth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents