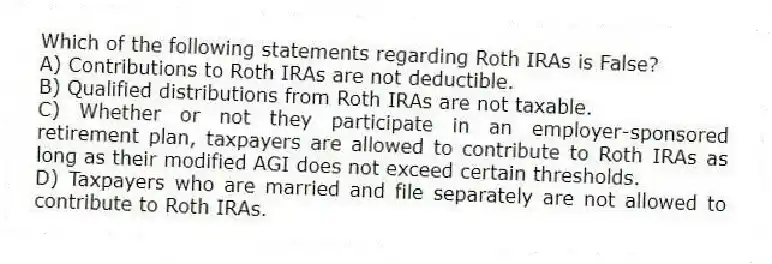

Which of the following statements regarding Roth IRAs is False?

A) Contributions to Roth IRAs are not deductible.

B) Qualified distributions from Roth IRAs are not taxable.

C) Whether or not they participate in an employer-sponsored retirement plan, taxpayers are allowed to contribute to Roth IRAs as long as their modified AGI does not exceed certain thresholds.

D) Taxpayers who are married and file separately are not allowed to contribute to Roth IRAs.

Correct Answer:

Verified

Q64: Kathy is 60 years of age and

Q65: Tyson (48 years old) owns a traditional

Q66: Tyson (48 years old) owns a traditional

Q67: Bryan, who is 45 years old, had

Q68: Which of the following statements regarding IRAs

Q70: Kathy is 48 years of age and

Q71: Which of the following statements concerning traditional

Q72: Kathy is 60 years of age and

Q73: Which of the following statements concerning individual

Q74: Which of the following statements regarding Roth

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents