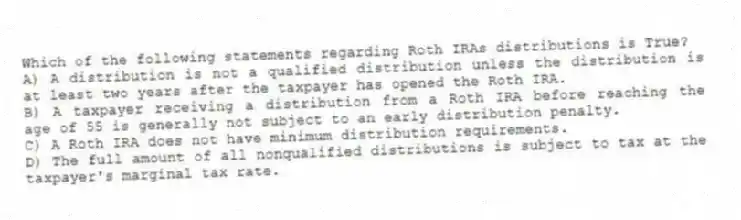

Which of the following statements regarding Roth IRAs distributions is True?

A) A distribution is not a qualified distribution unless the distribution is at least two years after the taxpayer has opened the Roth IRA.

B) A taxpayer receiving a distribution from a Roth IRA before reaching the age of 55 is generally not subject to an early distribution penalty.

C) A Roth IRA does not have minimum distribution requirements.

D) The full amount of all nonqualified distributions is subject to tax at the taxpayer's marginal tax rate.

Correct Answer:

Verified

Q69: Which of the following statements regarding Roth

Q70: Kathy is 48 years of age and

Q71: Which of the following statements concerning traditional

Q72: Kathy is 60 years of age and

Q73: Which of the following statements concerning individual

Q75: Jessica retired at age 65. On the

Q76: Lisa, age 45, needed some cash so

Q77: Which of the following is True concerning

Q78: Lisa, age 45, needed some cash so

Q79: Which of the following statements regarding self-employed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents