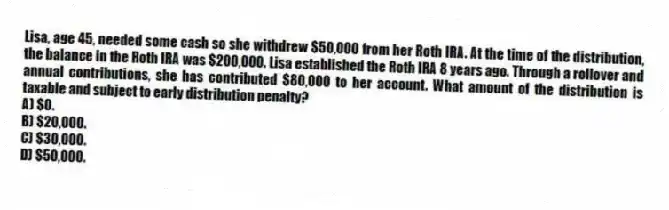

Lisa, age 45, needed some cash so she withdrew $50,000 from her Roth IRA. At the time of the distribution, the balance in the Roth IRA was $200,000. Lisa established the Roth IRA 8 years ago. Through a rollover and annual contributions, she has contributed $80,000 to her account. What amount of the distribution is taxable and subject to early distribution penalty?

A) $0.

B) $20,000.

C) $30,000.

D) $50,000.

Correct Answer:

Verified

Q73: Which of the following statements concerning individual

Q74: Which of the following statements regarding Roth

Q75: Jessica retired at age 65. On the

Q76: Lisa, age 45, needed some cash so

Q77: Which of the following is True concerning

Q79: Which of the following statements regarding self-employed

Q80: Which of the following is not a

Q81: Joan recently started her career with PDEK

Q82: Keisha (50 years of age) is considering

Q83: On March 30, Rodger (age 56) was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents