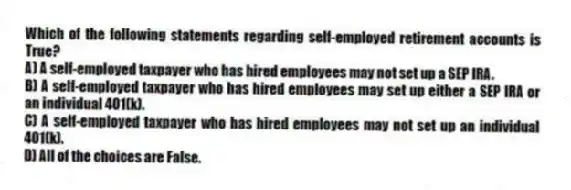

Which of the following statements regarding self-employed retirement accounts is True?

A) A self-employed taxpayer who has hired employees may not set up a SEP IRA.

B) A self-employed taxpayer who has hired employees may set up either a SEP IRA or an individual 401(k) .

C) A self-employed taxpayer who has hired employees may not set up an individual 401(k) .

D) All of the choices are False.

Correct Answer:

Verified

Q74: Which of the following statements regarding Roth

Q75: Jessica retired at age 65. On the

Q76: Lisa, age 45, needed some cash so

Q77: Which of the following is True concerning

Q78: Lisa, age 45, needed some cash so

Q80: Which of the following is not a

Q81: Joan recently started her career with PDEK

Q82: Keisha (50 years of age) is considering

Q83: On March 30, Rodger (age 56) was

Q84: Kathy is 48 years of age and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents