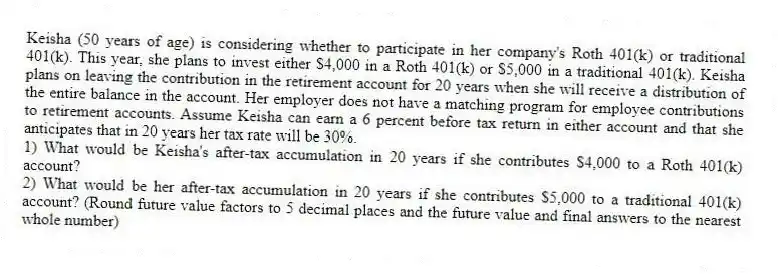

Keisha (50 years of age) is considering whether to participate in her company's Roth 401(k) or traditional 401(k). This year, she plans to invest either $4,000 in a Roth 401(k) or $5,000 in a traditional 401(k). Keisha plans on leaving the contribution in the retirement account for 20 years when she will receive a distribution of the entire balance in the account. Her employer does not have a matching program for employee contributions to retirement accounts. Assume Keisha can earn a 6 percent before tax return in either account and that she anticipates that in 20 years her tax rate will be 30%.

1) What would be Keisha's after-tax accumulation in 20 years if she contributes $4,000 to a Roth 401(k) account?

2) What would be her after-tax accumulation in 20 years if she contributes $5,000 to a traditional 401(k) account? (Round future value factors to 5 decimal places and the future value and final answers to the nearest whole number)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Which of the following is True concerning

Q78: Lisa, age 45, needed some cash so

Q79: Which of the following statements regarding self-employed

Q80: Which of the following is not a

Q81: Joan recently started her career with PDEK

Q83: On March 30, Rodger (age 56) was

Q84: Kathy is 48 years of age and

Q85: Kathy is 60 years of age and

Q86: Kathy is 48 years of age and

Q87: Amy is single. During 2018, she determined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents