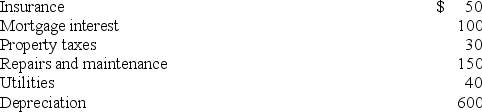

Kristen rented out her home for 10 days during the year for $5,000. She used the home for personal purposes for the other 355 days. She allocated the following home expenses to the rental use of the home:

Kristen's AGI is $120,000 before considering the effect of the rental activity. What is Kristen's AGI after considering the tax effect of the rental use of her home?

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Joshua and Mary Sullivan purchased a new

Q102: Mercury is self-employed and she uses a

Q109: Rayleen owns a condominium near Orlando, Florida.

Q110: Don owns a condominium near Orlando, California.

Q111: Don owns a condominium near Orlando, California.

Q112: Careen owns a condominium near Newport Beach

Q113: Rayleen owns a condominium near Orlando, Florida.

Q114: Careen owns a condominium near Newport Beach

Q115: Tyson owns a condominium near Laguna Beach,

Q118: Tyson owns a condominium near Laguna Beach,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents