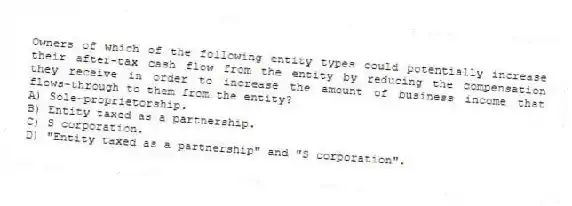

Owners of which of the following entity types could potentially increase their after-tax cash flow from the entity by reducing the compensation they receive in order to increase the amount of business income that flows-through to them from the entity?

A) Sole-proprietorship.

B) Entity taxed as a partnership.

C) S corporation.

D) "Entity taxed as a partnership" and "S corporation".

Correct Answer:

Verified

Q61: Assume you plan to start a new

Q65: From a tax perspective, which entity choice

Q66: From a tax perspective, which entity choice

Q68: If you were seeking an entity with

Q75: P corporation owns 60 percent of the

Q76: What is the tax impact to a

Q76: Stacy would like to have SST (a

Q79: David would like to organize HOS (a

Q79: Which of the following statements is True

Q80: Jorge is a 60 percent owner of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents